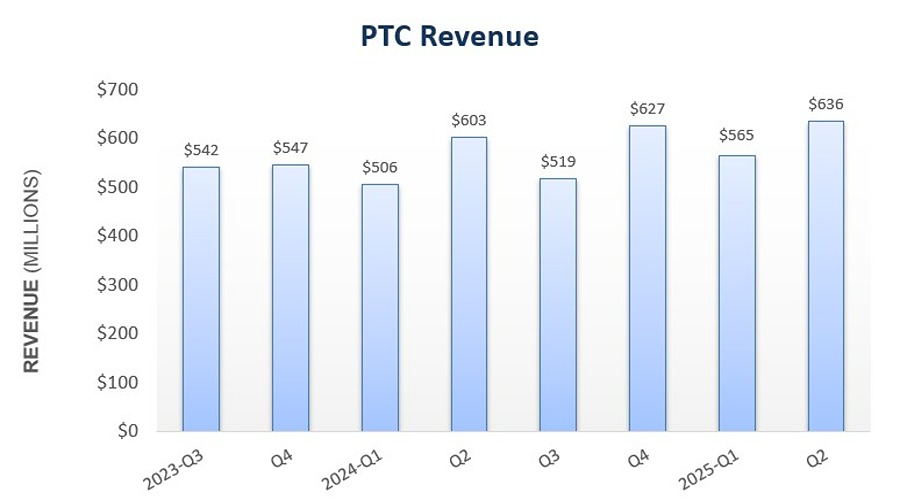

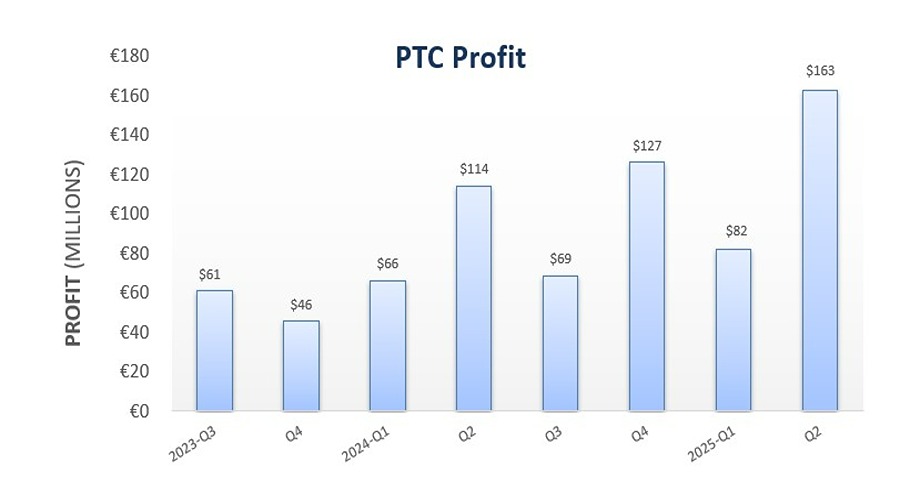

BOSTON, MA, May 1, 2025 – PTC has announced its Q2 FY25 results, reporting $636M in revenue – a 12.6% increase from $565M in Q1 FY25 – with a profit of $163M.

Second Quarter Financial Highlights

- ARR reached $2.33 billion, up 10% year over year (constant currency).

- The operating cash flow rose 12% year over year.

- Free cash flow was $279 million, up 13% year over year.

- EPS of $1.79, beating the expected $1.40.

- CAD revenue grew 8% year over year.

- PLM revenue rose 11% year over year.

- Repurchased $75 million in shares under $2B buyback plan.

“Q2 was a solid quarter for us, and I remain extremely optimistic about our position as an enabler of the digital economy – particularly our position as a supplier of software tools that make our customers more efficient as they design, manufacture, and service their products,” said Neil Barua, president and CEO, PTC.

“While the current macroeconomic uncertainty makes it challenging for us to predict precisely how our customers will react, PTC is in a better position today to meet our customers’ demand than ever before. I am confident that PTC can help our customers navigate this period by accelerating their continued transition into the digital age,” concluded Barua.

“In Q2’25, the selling environment remained challenging. Given this backdrop, our ARR was solid, growing 10% year over year. Our Q2’25 cash flow was also solid, with operating cash flow growing 12% year over year and free cash flow growing 13% year over year, driven by our ARR growth, subscription business model, and diligent financial management. Additionally, we continued to execute our capital allocation strategy in a disciplined and consistent manner, repurchasing $75 million worth of our stock in Q2’25,” said Kristian Talvitie, CFO.

A detailed chart outlining the financial results is available here, providing a comprehensive breakdown of key metrics and performance indicators for better insight into the company’s financial standing.

Source: PTC

About PTC

PTC Inc., founded in 1985 and headquartered in Boston, MA, is a technology company that provides software solutions focused on digital transformation. Its offerings include product lifecycle management (PLM), CAD, Industrial Internet of Things (IIoT), and augmented reality (AR). These tools improve product design, manufacturing, and service operations. PTC serves a f industries including aerospace, automotive, electronics, and industrial equipment. Its solutions are used by more than 30,000 customers worldwide, including 95% of Fortune 500 discrete manufacturing companies. With around 7,500 employees globally, the company continues to grow through its subscription-based model and focus on enabling smarter, efficient digital product innovation across industries.